New wine stoppers

A version of this article first appeared in Harpers Wine and Spirit, August 2009.

A flurry of activity, mostly generated by customer demand for innovation, has seen several new closures on the market, both for premium and high volume wines. TCA (2,4,6-trichloroanisole, the chemical that causes musty off flavour in wine) has given way to OTR (oxygen transmission rate); new stoppers have been brought out for sparkling wines, and marketeers are getting back on the act as closure choice becomes a way to differentiate brands.

Three new sparkling wine stoppers have appeared.

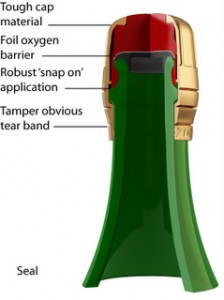

Three new sparkling wine stoppers have appeared. Alcan’s Maestro stopper has all the pizzazz Champagne could want, and it is built around the utilitarian crown cap, which frequently does the stopper-work in maturation cellars before disgorgement. The functional cap is dressed to the nines with thick foil and the new one-arm bandit opening mechanism.

The business bit of of the Maestro

Crown caps with synthetic liners have been used in Champagne for more than 10 years. Maestro uses a single piece liner of “unique shape that gives it a better sealing, with a thicker layer of polyethylene” said Mathias Mélan Moutet, president of cap-maker Solocap-Mab, which, he said, gives it a CO2 loss well within the lowest third of the CIVC’s ‘acceptable’ range.

Bruno de Saizieu, the commercial and marketing director of Maestro-maker Alcan Packaging Capsules cheekily smiled “the effort to open it is easy enough for a woman to do”. The opening is made simpler without the foil to unwrap and the wire to unwind. Restaurants should love it.

Australian company Zork has brought out a plastic stopper for sparkling wine, based on the technology for its still wine stopper. It comes at a cost they say is comparable to cork-plus-wire, but, said marketing manager Jo Baker “the big cost saving for producers is to opt for no [foil].”

Zork sparkling

Evans and Tate have used this on their new sparkler Zamphire. Rosemary Scott, their general manager for global sales and marketing, said “the re-sealable closure appeals to consumers as it allows them to have a glass or two, reseal the bottle and save the rest for another day. Equally, almost 50% of Australian sparkling wine consumers who we surveyed said they found it difficult to open bottles. The new closure allows more control when opening while still providing the traditional ‘pop’ and ceremony.”

The semi-sparkling (frizzante) market is big in Italy, and Guala Closures has brought out the ‘Moss’ (Italian for slightly fizzy) screwcap for semi-sparklers. Marketing manager Anne Seznac said the screwcap “was used for small formats, but not for big formats until requests came from Italy, Argentina and Brazil” for something easy to open and close for younger consumers.” A polyethylene liner was developed, but the shell of the screwcap and the bottle are the same, so, she said, only an adjustment to the block pressure of the capping heads needs to be made.

With Prosecco resurgent, as well as semi-sparkling usually attracting a lower duty rate in the UK than sparkling, this could be an interesting development, although Neil Bruce, wine director at Waverley TBS said he would want to know “firstly, if we have a need for a semi-sparkling. Is there enough innovation in the wine?” With 85% of Waverley’s business being in the generally slow-to-innovate, fragmented on trade, he added innovation in the on trade “tends to be supplier led.”

'Moss' screwcap for semi-sparklers

For still wines, a number of premium products have been launched and brand differentiation is emerging as a consideration for choice. After nearly five years without reported quality issues, glass stopper Vinolok’s general manager Siegfried Landskrone said the stopper’s “attributes combine the oenological standpoint of a proven system, and it meets the aesthetic view of a new trend for customers – it’s easy to open, there’s no extra tool, it’s a more modern and fashionable way, and it meets the emotional requirements for how a closure should look.”

Landskrone said: “Vinolok is moving from a purely technical solution, where the main contact was the winemaker. In the last 18 months this has changed to the sales and marketing guys. Where people are producing wines for export, more wineries are looking for marketing strategies to makes attractive packages.” He added in terms of cost Vinolok is comparable to high quality natural cork, so it’s not an option for many.

Peter Gago, chief winemaker for Penfolds agrees that “aesthetically and psychologically people have a lot of trust in glass.” Indeed Penfolds are at the very early stages of trialling two prototypes of true glass-on-glass stoppers, though phase one is not yet complete, Gago’s confidence notwithstanding: getting a glass disc appropriately fixed onto the levelled top of a bottle. If this development is successful, said Gago, “it will be for wines meant to age long term, the upper end of our portfolio,” adding “the proof is we have bottles [Grange] under this seal for over a year now. It’s working.”

Another product aspiring to the premium niche is Econatur from cork producer Juvenal. Cork is undeniably the most environmentally-friendly wine stopper, and Juvenal have amalgamated cork harvested from their 600 hectare organically-certified forest with cork from FSC-certified forests to produce a range of corks they market as ‘chemical-free’.

Econatur one-piece cork

Rui Pereira, sales director of Juvenal said “the idea had been just to do single-piece cork, but there was pressure from customers to include technical corks”, which has already given Juvenal orders for 1m stoppers.

At the high volume end of things, cork giant Amorim have re-launched a single-piece cork stopper, targeted at the fighting end of the market where clients want whole cork not technical (cork particles/discs of whole cork), but have not been able to afford it. It is cited as being able to undercut the alternatives by up to 50%.

Communications director Carlos de Jesus said Aquamark is a single piece “lower quality natural cork stopper wrapped in new technology, which is sensorially neutral and has a visually-appealing result while keeping costs at a price point that brings natural [single piece] cork stoppers to price sections from which they were previously excluded.”

The price range was given between €35 and €110/1000, and de Jesus added: “Since we launched five months ago, 100 new clients have started using it, including some brand new customers.”

Acquamark stopper

The cost competitiveness of such a product may be the only thing that gets the UK trade interested. Matt Dickinson, director at Thierry’s said: “I look at [innovation] from two perspectives: what will the consumer think, and what will our customer think? And what about the cost? Can we benefit because of the cost, or for profile?”

He explained: “For cost and profile, commercially it depends on type of product. If mass market, finding as perfect a closure as possible for as little as you can pay is the route to go down. Any saving we can make on any aspect of packaging is a good thing, especially if it improves the overall quality of the liquid.” But, he warned. “the consumer is key to all this. If they don’t accept a particular type of closure, you need to find ways of bringing them on board.”

A different strategy has been adopted by Nomacorc who are working with scientific institutions to understand oxygen management throughout winemaking to arrive at “the sensory profile of the wine that the winemaker wants” said Malcolm Thompson, vice president of marketing and innovation, adding “OTR is one aspect. We have learned that oxygen management upstream is critically important. Ultimately we’ll look at pre-bottle ageing, micro-oxygenation and try to bring the whole process under control.” Adding “we’re aligning the research to our closures, and we can imagine a range of closures with different OTRs.” In the meantime their customers get valuable insight.

Such total control for reliability and consistency should elicit the interest of the big brand owners. Though, having adopted screwcaps 18 months ago, Greg Wilkins, director of Brand Phoenix, owners of First Cape, said: “for brand owners, consistency is the most crucial factor. We evaluate new closures periodically [but] we’re fairly conservative. Once we’ve found one that works, then the person who is the most important is the consumer.”

Pernod-Ricard’s wines development director, Adrian Atkinson was equally circumspect, saying: “Whist we do keep up to date on new closures, we have put a lot of time and research investing in screwcap closures – it is a commercially viable investment for Jacob’s Creek both now and for the foreseeable future.”

Ultimately, no matter the innovation, it has to stand firm with consumers. David Gill MW, director of Bottle Green said “It’s all very well if we or the retail buyer thinks it’s a good idea, but will the consumer buy it?”